Menu

Office/Meeting Room For Rent Next to BTS Phaya Thai

Private Limited Company Registration

VAT Registration (VAT)

The name you can choose for your company must not be identical to or resemble the name of a pre-existing registered partnership or company.

Certain terms are also prohibited from being used in company names. For example, the term investment cannot be used, but capital can be used. The company name must end with the word Limited.

The name must be reserved with the Department of Business Development (DBD) of the Ministry of Commerce. It is recommended to reserve three names ranked by priority to maximise the chances of your success.

The company name will be registered in Thai, even if its name is in English. Do not propose a name that is lengthy of difficult for non-English speakers. The name of your business can be different from the company name. You can also use the same name for several companies provided that you accompany the name with a different figurative word (for example, ABC Trading Ltd, ABC Holdings Ltd or ABC Capital Ltd).

Once the name is approved, the name will be valid for 30 days, and no extension is permitted. Within this period of time, step two must be completed.

The MOA is a special agreement made by the founders (promoters) of the company. The MOA must include the following details:

The statutory meeting can be convened as soon as you register the memorandum of association.

Its purpose is to:

The resolutions of the Statutory Meeting will not be valid unless passed by a majority, including at least one half of the total number of subscribers entitled to vote.

The application can be lodged at the Ministry of Commerce on the same day that the memorandum of association is registered, provided that the Statutory Meeting has already been convened.

The registration application must be lodged no later than three months from the date of the Statutory Meeting, or you will need to provide an explanation for the delay.

The following details must be provided in the application:

The company director will also need to sign a statement attesting that each shareholder has paid their share subscription.

Receipts must be signed by the director and mention:

The registration fee for a private limited company is THB 5,500 per THB 1 million of the registered capital.

Once your company has been registered and within 60 days of incorporation or the commencement of operations, you will need to apply for and obtain a company corporate tax ID card from the Revenue Department.

If your company has a turnover of more than THB 1.8 million per annum and is not subject to Special Business Tax, you must register for VAT within 30 days of the date the company’s turnover exceeds the threshold.

Specific business tax (SBT) is a tax imposed on businesses that are excluded from VAT. Certain businesses are also subject to SBT instead of VAT.

A company that has one or more employees must register at the Social Security Office within 30 days of hiring its first employee.

Foreigners who are legally working in Thailand must also register with the Social Security Office and are entitled to the same benefits as Thai employees.

If the registration is not made within the specified time, the employer will be liable to imprisonment of not exceeding six months or a fine of not more than THB 20,000, or both.

Conclusion

Foreign investors have several business structures they can choose if interested in setting up a business in Thailand. Contact Acclime to guide you through the steps of registering a company in Thailand hassle-free.

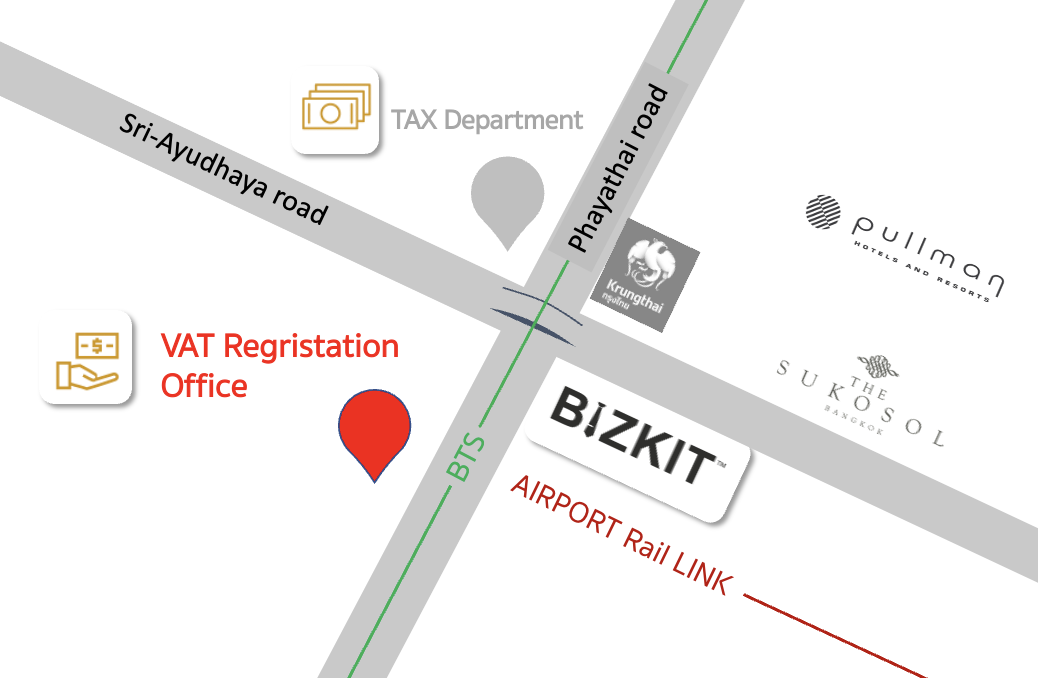

Where to register for VAT?

For those whose office is with Bizkit Office, VAT registration office is about 200 m across the street from Bizkit office.

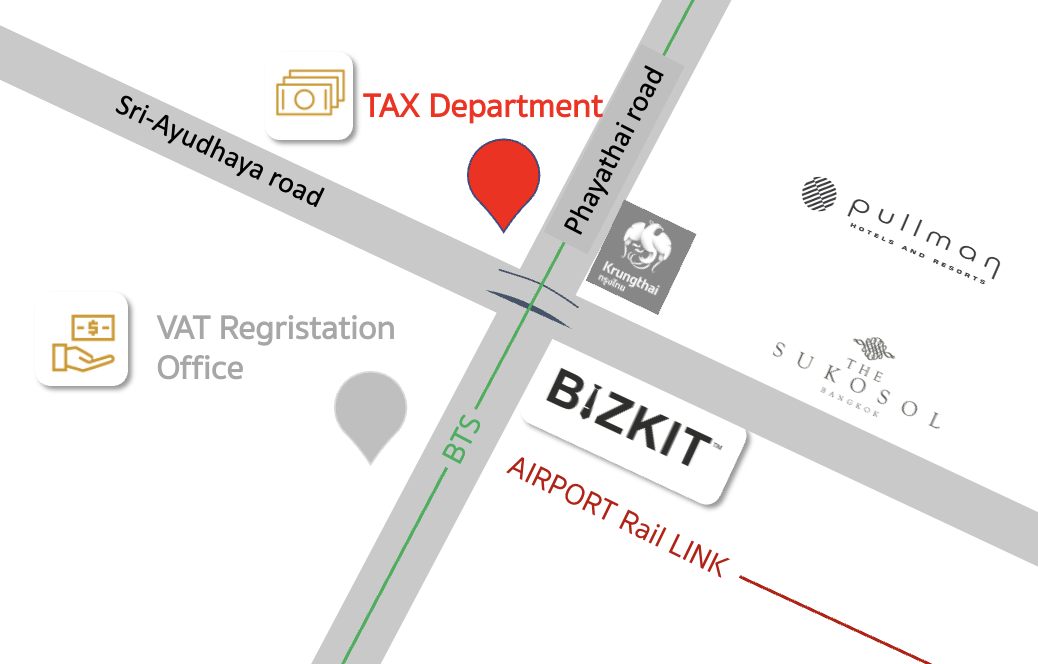

Where to pay monthly TAX?

For those whose office is with Bizkit Office, Tax department only 50 m across the street from Bizkit office.

ฝากข้อความถึงเรา! Leave us a message for more information.